HOA Insurance Types

Welcome to "The Ultimate Guide to HOA Insurance," your essential resource for understanding insurance in the context of Homeowners Associations (HOAs). This guide simplifies the complexities of HOA insurance for board members, property managers, and homeowners alike, ensuring you're well-equipped to protect your community and investments.

Insurance is a vital component of community living, guarding against unexpected events such as property damage, liability claims, and legal disputes. Given the variety of policies each with distinct coverages and exclusions, grasping the nuances of HOA insurance can be challenging.

Our guide aims to clarify these intricacies, offering expert insights and actionable advice to confidently manage your HOA's insurance needs. From the basics of property and liability insurance to the specifics of directors' and officers' coverage and the claims process, we cover key topics relevant to HOAs.

Let's dive into the world of HOA insurance together, armed with the insights needed to make wise insurance choices for your community.

Understanding HOA Insurance

Definition and Basics of HOA Insurance: What It Is and Why It's Needed

Homeowners Association (HOA) insurance is a specialized form of coverage designed to protect HOA communities against various risks and liabilities. This type of insurance is critical for managing and mitigating the potential financial impacts of unexpected events, such as property damage, legal liabilities, and other risks that can affect both the physical assets of the community and the financial stability of the HOA and its members.

Understanding HOA Insurance Coverage

At its core, HOA insurance encompasses several types of policies, each tailored to cover different aspects of community management and protection. These can include property insurance for common areas, liability insurance for the association’s board members and volunteers, and even disaster coverage for unforeseen events like floods or earthquakes. The precise nature and extent of coverage required can vary significantly depending on the size of the HOA, the amenities it offers, and the specific risks associated with its geographic location.

The Importance of Comprehensive HOA Insurance

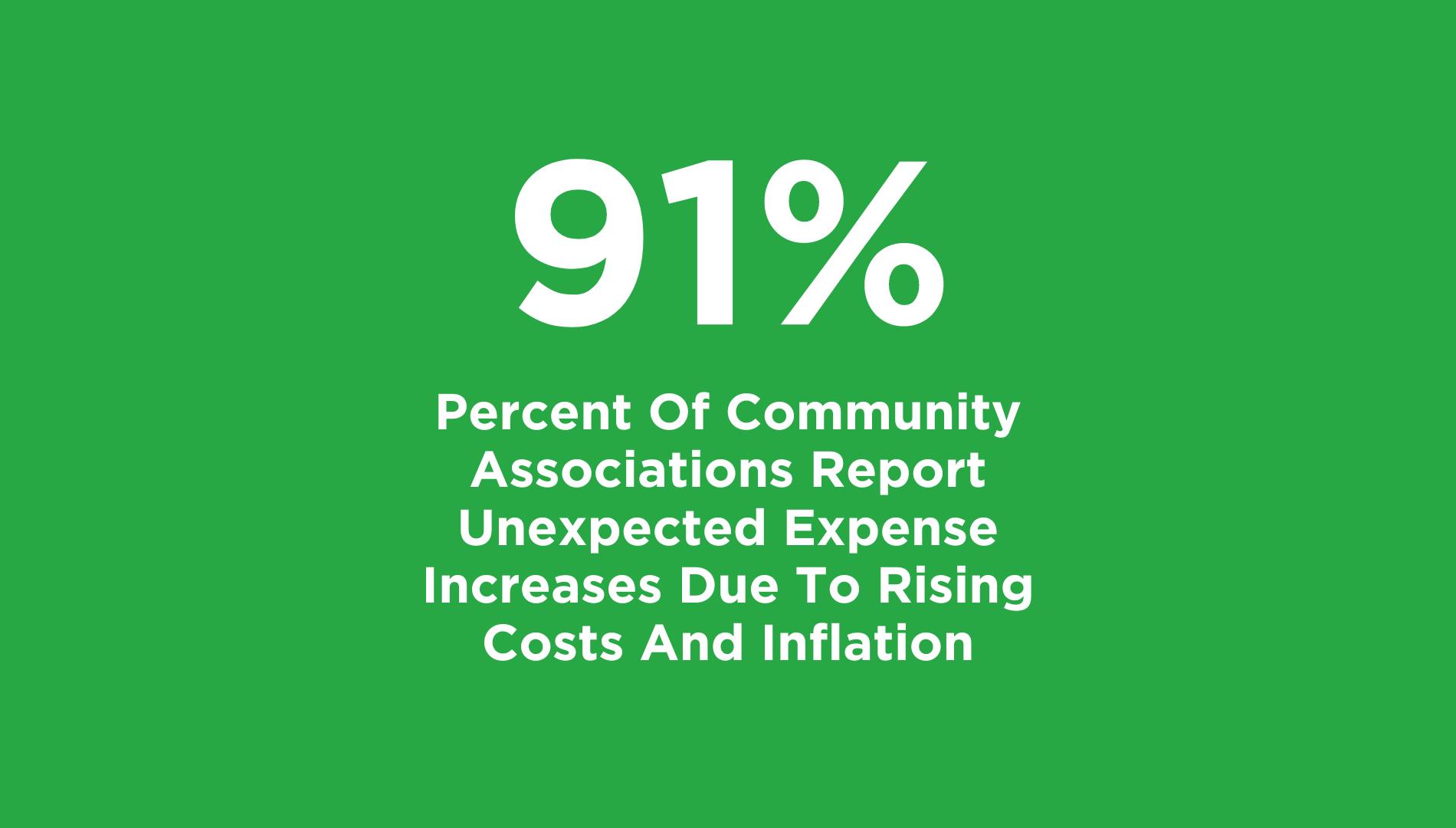

The necessity of HOA insurance stems from the collective responsibility of homeowners associations to maintain and protect the shared spaces and structures that define community living. This responsibility not only involves the upkeep and improvement of physical assets but also includes safeguarding the association and its members from the financial fallout of legal claims or damages. Without adequate insurance coverage, an HOA could face severe financial strain, potentially resulting in increased dues or assessments for its members to cover repair costs, legal fees, or other liabilities.

Navigating HOA Insurance: Types and Real-Life Applications

Homeowners associations (HOAs) require insurance to protect their communities from various risks and liabilities. Understanding the different types of coverage and learning from real-life scenarios can help you understand your HOA policies and be better prepared for potential challenges. In this blog post, we'll run through the types of insurance for HOAs and provide examples.

Types of Coverage Provided by HOA Insurance Policies

Directors & Officers (D&O) Insurance

D&O insurance covers board members against claims of mismanagement, errors, and omissions while serving on the HOA board. This type of coverage is essential for protecting board members from personal financial liability in the event of a lawsuit.

Example: A homeowner sues the HOA board or a specific individual on the board, alleging that their property value decreased due to the board's mismanagement of a common area landscaping project. The D&O insurance should cover the legal expenses and any potential settlement or judgment related to the claim.

General Liability Insurance

HOA General Liability Insurance protects the association against claims for bodily injury or property damage that may occur in common areas or result from the association's activities.

Example: A visitor trips and falls on an uneven sidewalk in the community, resulting in significant injuries. The visitor files a lawsuit against the HOA for their medical expenses and lost wages. General Liability Insurance should cover the costs associated with the claim.

Property Insurance

Property Insurance for HOAs covers damages to the common areas and shared elements of the community, such as clubhouses, swimming pools, and fences. This coverage is necessary to repair or replace damaged property due to events like fires, storms, or vandalism.

Example: A severe storm causes a tree to fall on the community clubhouse, damaging the roof and causing water damage to the interior. Property Insurance would cover the costs of repairing the roof and addressing the water damage.

Fidelity Insurance (Crime Coverage)

Fidelity Insurance protects the HOA from losses due to theft, fraud, or dishonest acts by board members, employees, or volunteers handling the association's funds.

Example: The HOA treasurer embezzles funds from the association's bank account for personal use. Fidelity Insurance for HOAs should cover the financial loss resulting from the treasurer's actions.

Workers' Compensation Insurance

Workers' Compensation Insurance covers medical expenses and lost wages for employees or volunteers injured while performing tasks on behalf of the HOA.

Example: A maintenance worker hired by the HOA suffers a back injury while repairing a fence on the property. Workers' Compensation Insurance should cover the worker's medical expenses and lost wages during their recovery period.

Umbrella Insurance

Umbrella Insurance provides additional liability coverage beyond the limits of general liability, D&O, and other liability policies. This extra layer of protection can be invaluable in the event of a large claim or lawsuit.

Catastrophic Insurance

Catastrophic Insurance plans kick in for large events like natural disasters like floods and wildfires, with coverage up to $25m.

Example: The HOA faces a substantial lawsuit stemming from a serious accident in the community pool area, and the damages exceed the limits of the general liability policy. Umbrella Insurance would cover the remaining costs, protecting the HOA's financial stability.

The coverage provided by HOA insurance policies is extensive, designed to protect the physical assets of the community, shield the association from liability, and safeguard the financial interests of its members. It's imperative for HOA boards to work with experienced insurance professionals to tailor their policies to the specific needs and risks of their community, ensuring comprehensive protection against the unexpected.

By understanding the types of coverage available, HOAs can make informed decisions about their insurance policies, ensuring that they have the necessary protections in place to support a safe, secure, and stable community environment.

The Claims Process

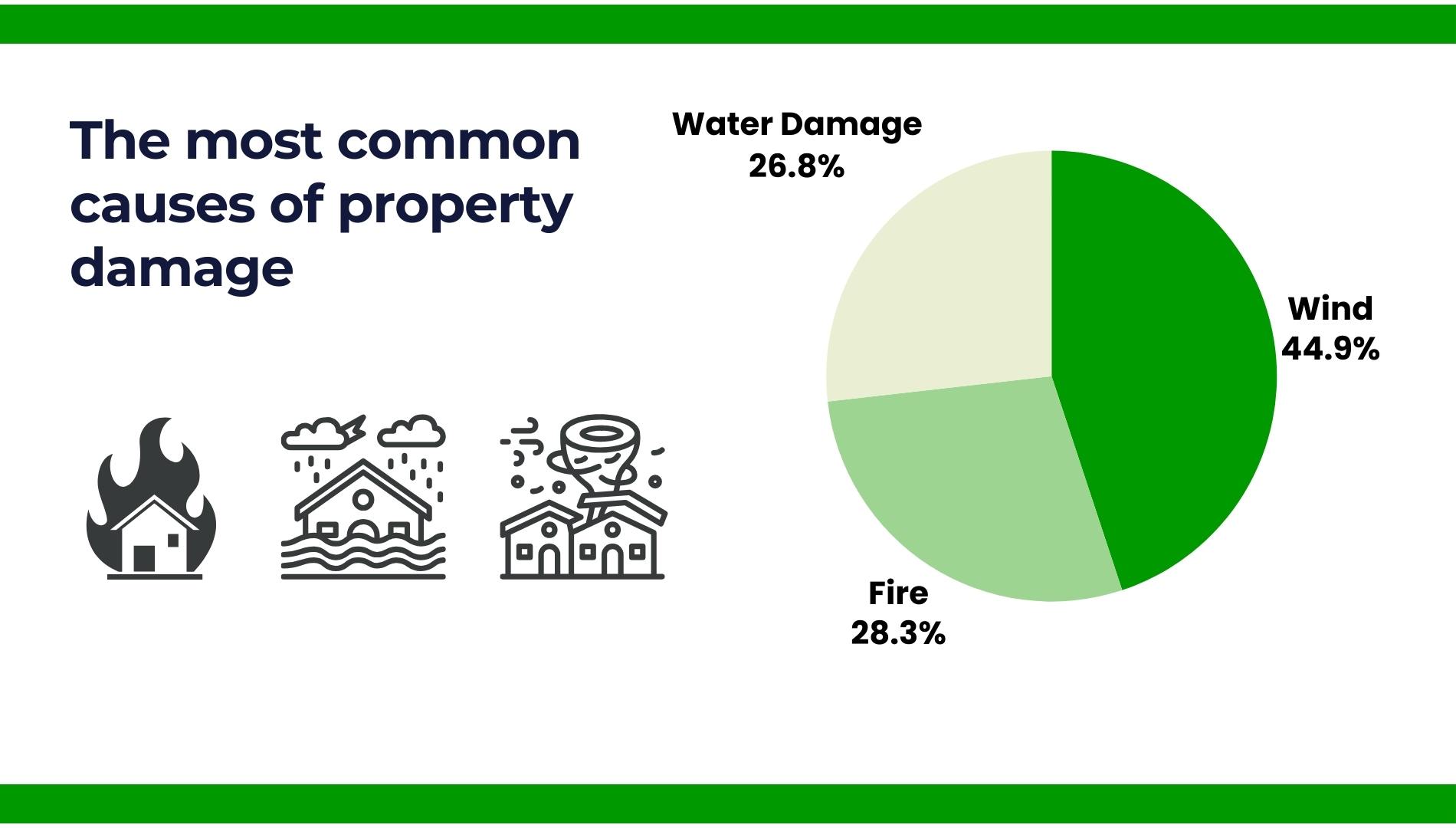

The most common causes of property damage according to homeowners insurance claims statistics are wind and hail (39.4%), fire and lightning (24.8%), and water damage and freezing (23.5%)

Understanding the insurance claims process is paramount for a Homeowners Association (HOA). Preparedness and a comprehensive grasp of the steps involved can significantly streamline the experience during potentially stressful times. This chapter aims to demystify the claims process, equipping HOA board members and managers with the knowledge to handle incidents efficiently and effectively, ensuring that the community's needs are promptly and adequately addressed.

Step-by-Step Guide on Filing an Insurance Claim

- Notification: The journey begins with immediate notification to the insurance provider following any incident or damage within the HOA's purview. Prompt communication is crucial, as delays can complicate or even jeopardize the claim. This initial step sets the claims process in motion, allowing the insurance company to begin their work without delay.

- Documentation: A critical component of the claims process is the compilation of supporting documentation. This may include photographs of the damage, police reports (for theft, vandalism, or other relevant incidents), repair estimates, and comprehensive accounts of what occurred. These pieces of evidence are vital for substantiating the claim and ensuring a fair assessment by the insurance provider.

- Assessment: Following documentation, the insurance company will conduct an assessment, often involving an adjuster's visit to evaluate the damages in person. This step is essential for the insurance company to understand the extent of the damage and determine the appropriate level of compensation.

- Claim Processing: The claim's processing phase is where the insurance company reviews all provided documentation and assesses the claim. This stage can involve several internal reviews and may require additional information or clarification, underscoring the importance of thorough and accurate initial documentation.

- Resolution: The climax of the claims process is the resolution phase, where the insurance company presents a settlement offer. If the settlement is deemed unsatisfactory, this stage may also involve negotiation or dispute resolution mechanisms to reach an agreeable conclusion. Ultimately, the process culminates in the final payout, allowing the HOA to repair damages and move forward.

Navigating Potential Obstacles

The claims process is not without its hurdles. Common challenges include disputes over coverage details, delays in claim processing, and navigating the intricacies of policy language. To overcome these obstacles, it's crucial to maintain open lines of communication with the insurance provider, meticulously document all interactions and correspondences, and, if necessary, enlist professional assistance to advocate for the HOA's interests.

By understanding these steps and preparing for potential challenges, HOAs can navigate the claims process more effectively, ensuring that they can swiftly address and recover from incidents, minimizing impact on the community and its residents.

Risk Management and Loss Prevention

Homeowners' associations (HOA), proactive risk management and loss prevention are pivotal in safeguarding the community and its assets. These strategies not only minimize the likelihood of incidents that could lead to insurance claims but also play a significant role in reducing the impact should such events occur. By implementing effective risk management and loss prevention measures, an HOA can ensure a safer, more secure living environment for its residents, ultimately contributing to the overall wellbeing and sustainability of the community.

Strategies for Minimizing Risk:

- Regular Maintenance: The cornerstone of any robust risk management plan is regular maintenance. This proactive approach involves the routine inspection and upkeep of common areas, facilities, and infrastructure within the HOA jurisdiction. Regular maintenance tasks, such as cleaning gutters, inspecting roofs, and ensuring that lighting in communal areas is functioning properly, can prevent property damage from escalating and mitigate potential liability risks. This preventative strategy not only helps in maintaining the aesthetic and functional value of the property but also significantly reduces the chances of accidents and the subsequent insurance claims that could arise from neglect.

- Safety Inspections: Conducting regular safety inspections is another critical component of an effective risk management strategy. These inspections should be comprehensive, covering all communal areas, facilities, and any amenities provided by the HOA. The goal is to identify and rectify potential hazards, such as uneven sidewalks, faulty playground equipment, or poorly lit areas, before they result in incidents. By identifying risks early and implementing corrective measures, the HOA can significantly reduce the likelihood of accidents and injuries within the community, thereby protecting its members and reducing potential insurance claims.

- Community Rules: Establishing and enforcing clear community rules is essential in preventing incidents and reducing liability. These rules should cover a wide range of topics, from pet ownership and noise levels to the use of communal areas and exterior modifications to properties. Clearly defined rules help set expectations for behavior within the community, contributing to a harmonious living environment. Moreover, when these rules are consistently enforced, they can deter actions that might lead to accidents or damages, thus playing a crucial role in minimizing risk. It's also important for the HOA to regularly review and update these rules to reflect the evolving needs of the community and to address any new potential risks that may arise.

Implementing these strategies for risk management and loss prevention is vital for any HOA. Through regular maintenance, safety inspections, and the establishment of community rules, HOAs can effectively minimize risks, thereby creating a safer, more secure community and reducing the likelihood and impact of incidents that could lead to insurance claims. This proactive approach not only benefits the HOA in terms of reduced liability and insurance costs but also enhances the quality of life for all residents.

Choosing the Right Insurance for Your HOA

Selecting the right insurance provider and policy is a pivotal decision for any Homeowners Association (HOA). This decision demands a careful evaluation of numerous factors to ensure that the coverage is not only comprehensive but also cost-effective. It's about finding a balance that protects the community's assets and interests without placing undue financial strain on its members.

Factors to Consider:

- Coverage Needs: The first step in selecting an insurance policy is to accurately assess the HOA's specific coverage needs. This assessment should consider the type of properties within the HOA, their location, and any unique risks associated with the community. For example, properties located in areas prone to natural disasters may require additional coverage for flood or earthquake damage. Understanding these needs upfront will help in identifying policies that offer the necessary protections without excessive costs for superfluous coverage.

- Insurance Provider: When evaluating potential insurance providers, it's essential to look beyond just the policy offerings. Consider the insurer's reputation in the industry, their financial stability, and their track record for customer service. A provider's ability to pay out claims promptly and effectively should not be underestimated. Researching online reviews, consulting industry ratings, and even seeking recommendations from other HOAs can provide valuable insights into an insurer's reliability and service quality.

- Role of Insurance Brokers/Agents: Insurance brokers or agents can be invaluable resources in the selection process. Their expertise allows them to understand the nuances of various policies and how they align with your HOA's needs. Brokers work on behalf of the HOA to compare quotes from multiple providers, negotiate terms, and even assist with the claims process when necessary. Their knowledge and industry connections can simplify the complex landscape of insurance options, ensuring that the HOA secures the best possible coverage at the most favorable terms.

When selecting an insurer for your Homeowners Association (HOA), it's crucial to conduct a thorough interview to ensure their offerings align with your community's needs. Here's a comprehensive list of critical questions to ask potential insurers. This list is designed to help you understand their coverage options, the claims process, and the flexibility of their policies, ensuring you make an informed decision that safeguards your community's interests.

Questions to Ask Potential Insurers

Coverage Details

-

What specific coverages are included in the HOA insurance policy?

- This question helps clarify what types of damage and incidents are covered under the policy, such as property damage, liability, directors and officers D&O Insurance, and more.

-

Can you explain any coverage exclusions or limitations within the policy?

- Understanding what is not covered is just as important as knowing what is covered to avoid surprises when a claim is filed.

-

Are there any unique coverage options for communities like ours (e.g., condos, gated communities, townhomes)?

- Different community types may have unique risks and needs, requiring specialized coverage options.

-

How are common areas, shared amenities, and individual units covered under the policy?

- Clarify the division of coverage between what the HOA policy covers and what residents need to cover through their personal insurance.

Claims Process

-

What is the process for filing a claim, and what documentation is required?

- Knowing the steps to file a claim and the necessary documentation helps streamline the process during stressful times.

-

What is the average resolution time for claims, and how are claim disputes handled?

- Understanding the timeline and dispute resolution process can help set expectations for claim processing.

-

How does the claims process work in the event of a major disaster affecting multiple homes or common areas?

- In the case of widespread damage, the claims process can be more complex, requiring clear understanding upfront.

Policy Customization and Costs

-

What options are available for customizing our policy to better fit our specific needs?

- Customization options can help ensure that your community is neither underinsured nor overpaying for unnecessary coverage.

-

How are policy premiums calculated, and what factors could potentially increase our rates?

- Understanding the cost drivers can help an HOA manage its insurance expenses more effectively.

-

Are there any discounts or incentives for implementing risk management or loss prevention measures?

- Some insurers offer discounts for communities that take proactive steps to reduce their risk profile.

Support and Service

-

Can you provide examples of how you've supported other HOAs through significant claims or disasters?

- Real-world examples can give insight into the insurer's responsiveness and effectiveness in crisis situations.

-

What ongoing support and risk management advice do you offer to HOA clients?

- Beyond insurance, some insurers provide valuable advice and tools to help manage risks and prevent losses.

-

How do you ensure that the policy remains aligned with our community's evolving needs?

- As communities grow and change, it's important that their insurance coverage evolves accordingly.

This list of questions is a starting point for engaging with potential insurers. The answers will provide a deep dive into each insurer's approach to coverage, claims, policy customization, and support, helping your HOA board make a well-informed decision.

Conclusion

Navigating the complex landscape of Homeowners Association (HOA) insurance requires a meticulous approach, underscored by a commitment to safeguarding the community's financial and structural well-being. As we've journeyed through the intricacies of insurance policies, the claims process, risk management, and the selection of the right insurance partner, several key themes have emerged.

Sources

- Insurance Information Institute. (n.d.). Facts + Statistics: Homeowners and renters insurance. Retrieved from https://www.iii.org/fact-statistic/facts-statistics-homeowners-and-renters-insurance

- RubyHome. (n.d.). HOA Stats. Retrieved from https://www.rubyhome.com/blog/hoa-stats/

- DoorLoop. (n.d.). HOA Statistics. Retrieved from https://www.doorloop.com/blog/hoa-statistics

- Quicken Loans. (n.d.). Homeowners Insurance Statistics. Retrieved from https://www.quickenloans.com/learn/homeowners-insurance-statistics

- Policygenius. (n.d.). What is HOA insurance? Retrieved from https://www.policygenius.com/homeowners-insurance/what-is-hoa-insurance/