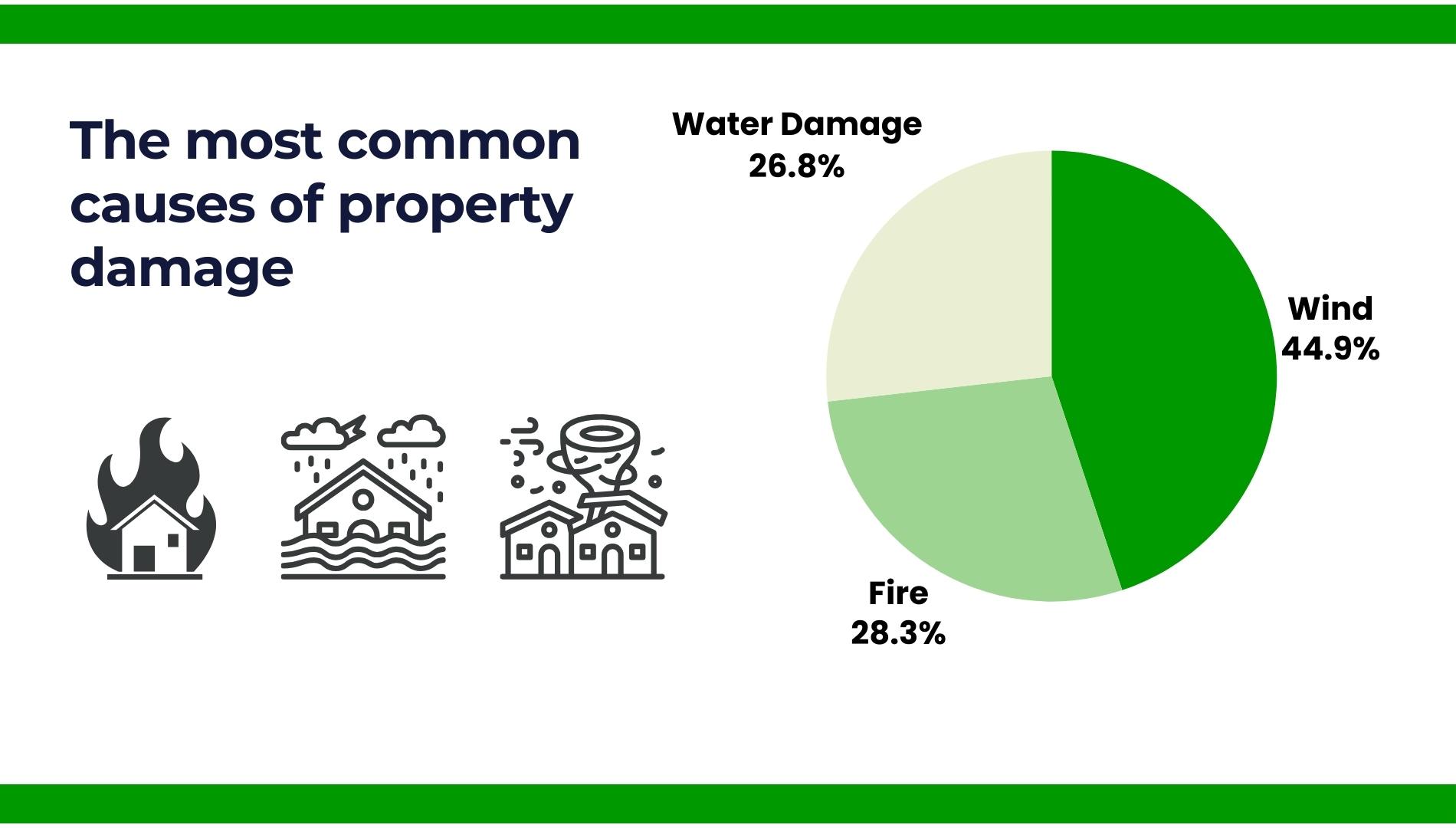

In our ever-changing environment, where natural disasters have become both more frequent and ferocious, the role of homeowners associations (HOAs) in protecting their communities is more crucial than ever. Catastrophic events—earthquakes, typhoons, hurricanes, floods—pose significant risks to properties and can lead to devastating consequences. This stark reality brings HOA catastrophic insurance into sharp focus, highlighting its importance as not just a safeguard but a necessity for communities. Let's delve deeper into what HOA catastrophic insurance entails, why it's indispensable, and steps to ensure your community is well-protected.

What is HOA Catastrophic Insurance?

HOA catastrophic insurance, also known as natural disaster or catastrophe insurance, is specifically designed to shield HOAs from the severe financial impact caused by major natural disasters. This type of insurance coverage is crucial for the protection of common areas and structures under the HOA's purview, such as parks, playgrounds, and building exteriors, particularly in condominium complexes. It’s a financial safeguard that enables communities to rebuild and recover in the aftermath of destructive natural forces.

The Imperative of HOA Catastrophic Insurance

The increasing incidence of natural disasters worldwide underscores the unpredictability and severity of nature's might. For HOAs, lacking catastrophic insurance is akin to leaving the community's fate to chance. Given the tangible risks, especially in disaster-prone areas, it's a risk that's too high to ignore.

The financial repercussions of rebuilding after a disaster can be overwhelming. Catastrophic insurance serves as a crucial financial buffer, ensuring that the community can afford to rebuild without draining reserves or levying significant assessments on residents. It's about maintaining financial stability in the face of adversity.

For residents, their home represents both a sanctuary and a significant investment. The assurance that comes with comprehensive catastrophic insurance coverage can't be overstated. It provides residents with the confidence that, even in the worst scenarios, the community has the means to recover and rebuild.

Steps to Ensure Adequate Protection

Understanding your community’s specific vulnerabilities is the first step toward securing appropriate catastrophic insurance. Identifying whether your area is susceptible to earthquakes, floods, hurricanes, or other natural disasters will inform the level and type of coverage needed.

The intricacies of catastrophic insurance demand professional expertise. Engaging with insurance professionals who specialize in HOA policies can make a significant difference. They can help evaluate your community's needs, compare policies, and ensure you're receiving the most comprehensive coverage possible.

The risk landscape is ever-evolving, necessitating periodic reviews and updates to your insurance coverage. This ensures that your community remains adequately protected against new or changing risks. HOA board members play a critical role in this process, regularly reviewing the master policy and assessing the need for additional coverage.

Additional Insurance Resources

- HOA Umbrella Insurance

- HOA Workers' Compensation Insurance

- Fidelity Insurance for HOAs

- Property Insurance for HOAs

- HOA General Liability Insurance

- What Does Liability D&O Mean in Insurance?

- HOA Insurance Types and Real-Life Examples

Additional Considerations

In certain disaster-prone regions, standard policies may not encompass natural disaster insurance, compelling communities to secure separate policies for complete coverage. Regularly revisiting the master policy is essential to ascertain that it provides adequate protection. In the absence of such insurance, the HOA and its members might find themselves liable for damages stemming from natural disasters, emphasizing the importance of proactive measures.

Conclusion

The significance of HOA catastrophic insurance in today’s climate cannot be overstated. It's a fundamental component of a prudent risk management strategy, ensuring that communities can withstand and recover from the blows dealt by nature's most severe challenges. By investing in adequate catastrophic insurance, HOAs affirm their commitment to the resilience, safety, and financial security of their communities. In the landscape of community management, being prepared for the worst isn't just sensible—it's essential.

Sources:

-

HOA Management. (n.d.). Natural disaster insurance for HOA. Retrieved from https://www.hoamanagement.com/natural-disaster-insurance-for-hoa/

-

Forbes Advisor. (n.d.). HOA insurance: What it covers and how it works. Retrieved from https://www.forbes.com/advisor/homeowners-insurance/hoa-insurance/

-

Vesta Property Services. (n.d.). Why you should know what type of catastrophe insurance the HOA has on a building. Retrieved from https://vestapropertyservices.com/why-you-should-know-what-type-of-catastrophe-insurance-the-hoa-has-on-a-building/

-

Condominium Insurance Law. (2017, August). Assessments following catastrophe losses in Texas. Retrieved from https://www.condominiuminsurancelaw.com/2017/08/condominium-associations/assessments-following-catastrophe-losses-in-texas/

-

Professional Insurance Group. (n.d.). What does HOA insurance cover? Retrieved from https://www.proinsgrp.com/what-does-hoa-insurance-cover/

Crafted with the precision of AI, our blogs blend human insight with digital innovation for content that truly resonates.