Streamline HOA Finances

From dues collection to financial reporting, QuickBooks

helps treasurers stay organized and audit-ready all year long.

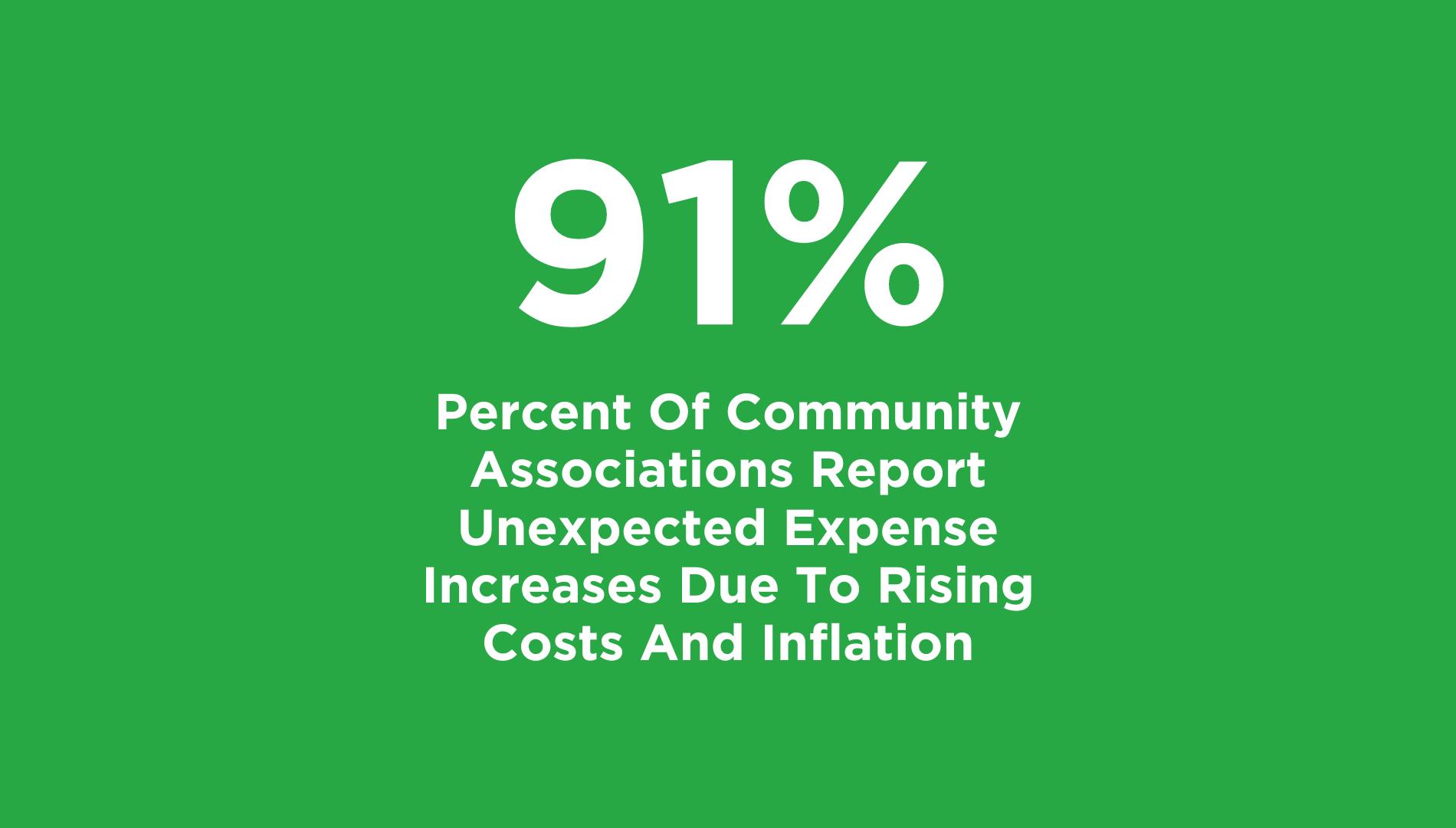

In 2023, 91% of HOA board members and community association managers reported unexpected expense increases due to rising maintenance costs and inflation.

About 35% of homeowners spend more on HOA fees than their monthly mortgage payments.

100,400,000 Volunteer hours of service performed annually by association board and committee members.

30 Percent of U.S. population in community associations.

62.7% of Residential HOA's have a Finance and Budget committee

$12.2 Trillion

Value of homes in community associations.

$371.2 billion

Economic contributions in 2023 including volunteer time, real estate taxes, home improvements, and services.

$108.8 Billion

Assessments collected from homeowners.

Budgeting and Financial Planning

The cornerstone of sound financial management lies in meticulous budgeting and planning. A well-crafted budget serves as a roadmap for the association's financial activities, enabling it to allocate resources effectively and achieve its goals.

Developing a Comprehensive Budget

Creating a comprehensive budget involves a thorough understanding of the association's income and expenses.

Identifying and Estimating Income Sources

The primary source of income for most community associations is assessments or dues collected from homeowners. Accurately estimating this income requires analyzing historical data, considering any planned increases, and factoring in potential delinquencies. Other income sources, such as rental income from common facilities or investment returns, should also be included.

Community associations typically rely on a few primary income sources to cover their expenses:

- Assessments and Fees: Regular dues paid by homeowners, which are used to fund operating expenses and contribute to reserve accounts.

- Special Assessments: Additional charges levied to cover unexpected expenses or major projects.

- Other Revenue: Income from amenities, fines, or rentals of common spaces.

Forecasting Operating Expenses

Operating expenses encompass the day-to-day costs of running the association, including landscaping, maintenance, utilities, insurance, and administrative expenses. Analyzing past trends, obtaining quotes from vendors, and considering inflationary factors can help in accurately forecasting these expenses.

- Historical Data Analysis: Review past financial records to identify trends in income and expenses.

- Anticipating Changes: Consider factors like inflation, new projects, or increases in service costs that may impact the budget.

- Allocating for Reserves: Include a portion of income specifically designated for the reserve fund to cover future repairs or replacements.

Establishing Reserve Funds

Reserve Funds are crucial for funding major repairs and replacements of common property components, such as roofs, swimming pools, and roads. Conducting a reserve study, which assesses the remaining useful life of these components and estimates their replacement costs, is essential for determining appropriate reserve fund contributions.

Long-Term Financial Planning

Beyond the annual budget, community associations need a long-term financial plan to ensure their long-term sustainability. A long-range financial plan typically spans 5 to 10 years and outlines the association's financial goals and strategies for achieving them. It incorporates projections of income, expenses, reserve contributions, and investment returns, providing a holistic view of the association's financial future.

- Define Objectives: Establish clear short- and long-term goals, such as maintaining common areas, funding capital projects, or improving amenities.

- Timeline: Develop a timeline for achieving these goals, balancing immediate needs with long-term priorities.

- Reserve Study: A reserve study is a comprehensive analysis of the association's reserve fund requirements. It evaluates the condition of major common area components, estimates their remaining useful life, and projects their replacement costs. This study provides a roadmap for funding future capital expenditures and helps avoid unexpected special assessments.

Smart Tools for Smart Boards

Whether you're reconciling payments or planning reserves, QuickBooks gives HOA boards professional-grade financial tools with zero fuss.

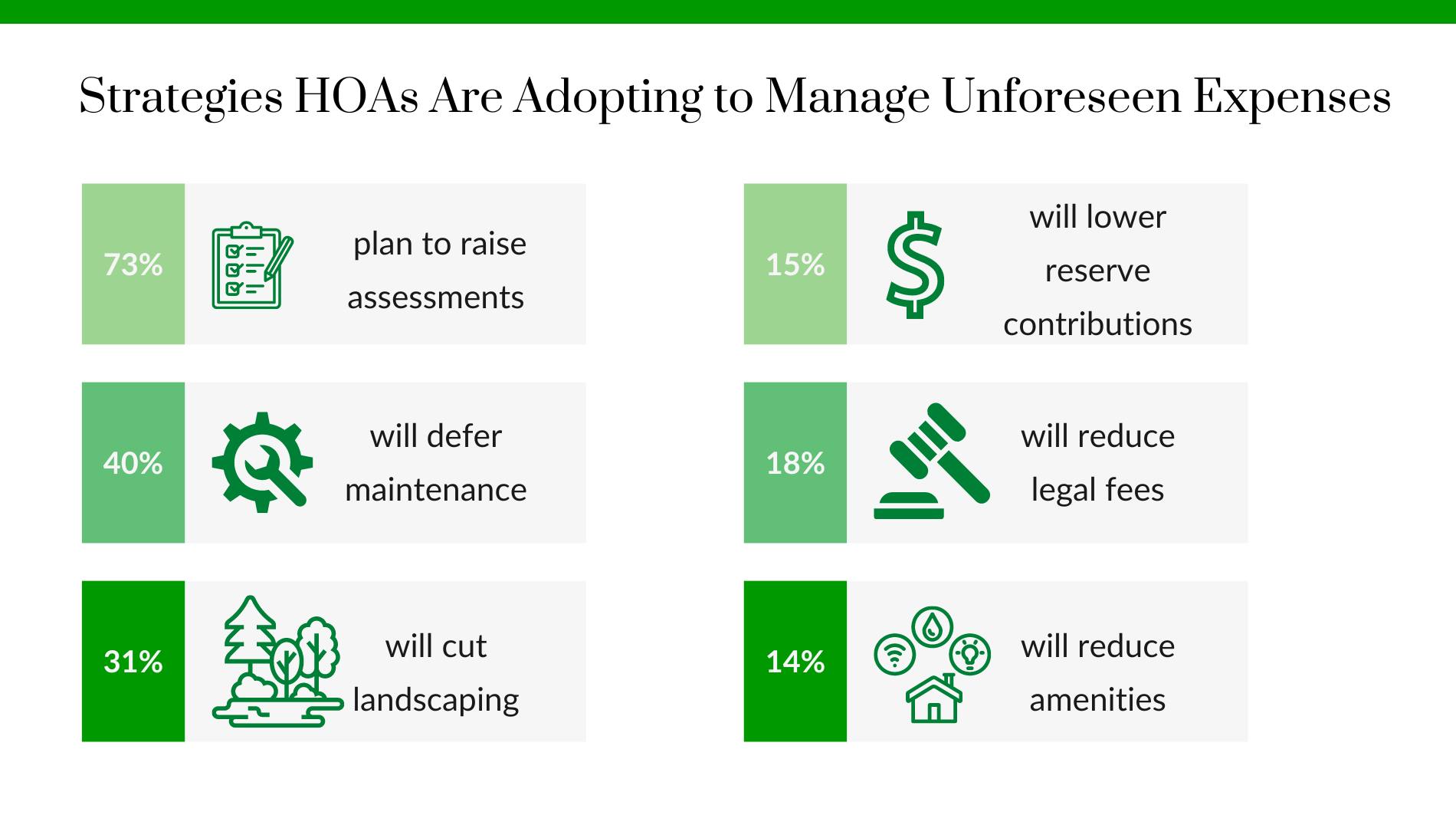

Incorporating Growth and Unforeseen Expenses

- Growth Considerations: Account for changes in membership, amenities, or property value that could impact finances.

- Emergency Preparedness: Build a financial cushion to handle emergencies or unexpected costs, such as storm damage or legal fees.

Financial Operations

Effective financial operations ensure the smooth functioning of the association and the preservation of its financial resources.

Assessment Collection

Collecting Assessments and Handling Delinquencies are the lifeblood of any HOA, providing the funds necessary to maintain common areas, pay for services, and invest in the community’s future. However, collecting these dues isn’t always straightforward. Late or unpaid assessments can strain the HOA’s budget and create tension among homeowners.

Setting Fair and Reasonable Assessments

Assessments should be set at a level that covers the association's operating expenses, reserve contributions, and any planned capital expenditures. Transparency in the budgeting process and clear communication with homeowners about the rationale behind assessment levels can foster understanding and cooperation.

Establishing and Enforcing an Effective Collection Policy

Establishing clear payment deadlines, offering convenient payment options, and sending timely reminders can encourage prompt payment of assessments. Implementing a late fee policy and utilizing collection agencies when necessary can help address delinquent accounts.

- Establish a written policy detailing assessment amounts, due dates, and payment methods.

- Offer multiple payment methods, such as online portals, automatic drafts, or checks, to encourage timely payments.

Handling Delinquent Accounts

Delinquent accounts can strain the association's finances and create tension within the community. Implementing a consistent and fair collection policy, offering payment plans when appropriate, and pursuing legal action as a last resort can help resolve delinquent accounts and minimize financial losses.

- Send reminders as soon as a payment is overdue, maintaining a tone of professionalism and understanding.

- Offer structured payment plans for homeowners facing temporary financial difficulties.

- Use liens or legal proceedings as a last resort, ensuring compliance with governing documents and state laws.

Investment Management

Investing association funds can help grow reserves and maintain long-term financial stability. However, it requires careful planning and adherence to legal guidelines to safeguard the association’s assets.

- Developing an Investment Policy: An investment policy outlines the association's investment objectives, risk tolerance, and permissible investment vehicles. It provides a framework for making informed investment decisions and ensures that investments align with the association's long-term financial goals.

- Selecting Appropriate Investment Vehicles: Choosing investment vehicles that balance risk and return, considering factors such as liquidity needs, investment timeframe, and risk tolerance, is essential for optimizing investment performance.

- Monitoring Investment Performance: Regularly monitoring investment performance, comparing returns to benchmarks, and rebalancing the portfolio as needed can help ensure that investments remain aligned with the association's objectives.

Expense Management

Prudent expense management is crucial for maximizing the association's financial resources.

Negotiating Contracts with Vendors

Controlling Operating Costs

Cost-Saving Measures

Reserve Fund Contributions

Understanding the Basics of Community Association Banking

Choosing the Right Banking Services for Your Association

Selecting the right bank and services is critical for secure and efficient financial operations. When evaluating banking options, consider:

- Experience with Associations: Look for financial institutions familiar with the needs of community associations.

- Specialized Services: Features like lockbox services for assessment payments, online banking access, and fraud protection tools can simplify financial management.

- Competitive Rates: Ensure the bank offers favorable interest rates for reserve accounts and reasonable fees for transactions or account maintenance.

Key Banking Tools and Features

Community associations should take advantage of banking tools designed to improve efficiency and security, such as:

- Online Banking: Provides easy access to account information, facilitates electronic payments, and simplifies financial reporting.

- Reserve Fund Accounts: Separate, interest-earning accounts for reserves help ensure compliance with financial best practices and legal requirements.

- Fraud Prevention Tools: Options like positive pay or dual-signature requirements for checks help safeguard association funds.

By mastering these financial management basics, community associations can establish a solid foundation for effective oversight and long-term fiscal health.

Financial Reporting and Transparency

Financial Transparency in HOAs to homeowners are essential for building trust and ensuring accountability.

Maintaining Accurate Financial Records

Accurate financial records provide a clear picture of the association's financial health and enable informed decision-making.

- Utilizing Accounting Software: Utilizing accounting software specifically designed for community associations can streamline financial management tasks, improve accuracy, and generate comprehensive financial reports.

- Preparing Financial Statements: Regularly preparing financial statements, such as balance sheets, income statements, and cash flow statements, provides a snapshot of the association's financial position and performance.

Providing Transparency to Homeowners

Open communication and transparency about financial matters foster trust and confidence among homeowners.

- Conducting Regular Financial Reviews: Conducting regular financial reviews, either internally or with the assistance of an independent auditor, can help identify potential financial issues and ensure compliance with accounting standards.

- Publishing Financial Reports: Making financial reports readily available to homeowners, either through newsletters, websites, or online portals, promotes transparency and allows homeowners to stay informed about the association's financial health.

- Holding Open Meetings to Discuss Financial Matters: Holding open meetings to discuss financial matters, answer homeowner questions, and address concerns can foster a sense of community and ensure that everyone is on the same page.

- Simplified Reports: Present financial information in a clear, concise manner using summaries, charts, and graphs to aid understanding.

Tools for Sharing Financial Updates

- Online Portals: Use secure websites or apps to provide homeowners with access to budgets, financial statements, and reserve studies.

- Community Meetings: Host meetings to discuss financial plans and address homeowner concerns directly.

- Email Communication: Send periodic email updates highlighting key financial developments or policy changes.

Ready to transform your community association's financial management?

Internal Controls and Fraud Prevention

Implementing internal controls and fraud prevention measures safeguards the association's financial resources and protects against potential losses.

Establishing Internal Controls

Internal controls are processes and procedures designed to ensure the accuracy and reliability of financial reporting, protect assets, and prevent fraud.

- Segregation of Duties: Segregating financial duties among different individuals helps prevent any single person from having too much control over financial transactions, reducing the risk of errors or fraud.

- Authorization Procedures: Implementing authorization procedures for expenditures, requiring multiple approvals for large transactions, and establishing clear spending limits can help prevent unauthorized spending.

- Regular Audits: Conducting regular audits, either internally or by an independent auditor, can help identify weaknesses in internal controls and ensure compliance with accounting standards.

Preventing Fraud

Fraud can have a devastating impact on community associations, leading to financial losses and eroding trust among homeowners. Regular financial audits and reviews play a crucial role in maintaining the financial health of a community association. This section highlights the benefits of these practices and their impact on homeowner confidence.

- Recognizing Red Flags: Being aware of potential red flags, such as unusual transaction patterns, unexplained account discrepancies, or a lack of transparency in financial reporting, can help detect HOA Embezzlement.

- Implementing Anti-Fraud Measures: Implementing anti-fraud measures, such as conducting background checks on employees and volunteers, requiring dual signatures on checks, and regularly reviewing bank statements, can help deter and prevent fraud.

- Error Detection: Audits and reviews identify discrepancies, errors, or signs of fraud in financial records.

- Accountability: Periodic reviews ensure funds are managed in accordance with governing documents and state regulations.

Have a Response Plan for HOA Embezzlement and fraud.

Treasurer’s Role in Promoting Financial Accountability

- Overseeing Finances: The treasurer ensures accurate record-keeping, prepares financial reports, and manages budgets.

- Compliance: Maintains adherence to legal, tax, and governing document requirements.

- Treasurer Report:This report serves as a comprehensive financial snapshot of the association's fiscal health. In this guide, we will provide you with a template for creating an effective HOA treasurer report that ensures transparent financial reporting and responsible stewardship.

Download a Free HOA Treasurer Report

Stay up-to-date on the financial health of you organization. Our latest Treasurer's Report is now available for download.

Conclusion

Effective financial management is paramount to the success and sustainability of community associations. By implementing sound budgeting practices, managing expenses prudently, maintaining transparency, and safeguarding against fraud, community associations can ensure their financial health and provide a thriving environment for their residents. Seeking guidance from professional advisors and utilizing available resources can further enhance financial management practices and contribute to the long-term well-being of the community.